Discover

“5 Changes In Startup Funding

in a Down Economy”

with our

Free Capital Crisis Guide

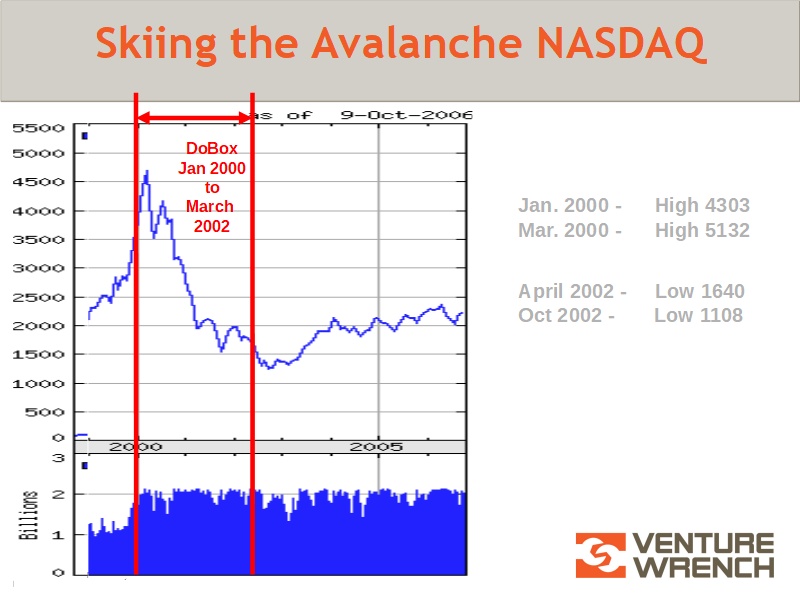

HI, I’m Nicole Toomey Davis. When I co-founded my first company, DoBox, the NASDAQ stock market was at all time highs, but it would begin a two and a half year plunge of over 75% shortly after we raised our first round. I always say that we “skied the avalanche” and had a successful exit anyway! As a note, the N ASDAQ would not return to the 5000 level until 2015 (yes, 15 years peak to peak!) Here’s a picture of the NASDAQ during the life of DoBox from first raise to company exit!

ASDAQ would not return to the 5000 level until 2015 (yes, 15 years peak to peak!) Here’s a picture of the NASDAQ during the life of DoBox from first raise to company exit!

I was raising capital during the this very difficult period and I want to share with other entrepreneurs 5 ways that raising startup capital is going to change as the stock markets continue to gyrate.

While public markets plunged and then gyrated, private investment from angel investors, venture capital firms and private equity firms dried up! And startup fundraising became excruciating. We know entrepreneurs who literally shut the doors and sent unused funds back to investors, because they knew they couldn’t raise follow-on startup funding.

Our Free VentureWrench Crisis Capital Guide

5 Changes In Startup Funding

in a Down Economy

With key insights to help you understand how raising startup capital

is changing while the stock market gyrates

to help you be more successful in raising capital from investors

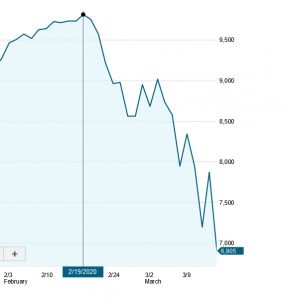

It’ s been a long time since entrepreneurs have had to face an avalanche like the one we lived through, but it appears that it’s time again. In the period from Feb 19, 2020 to March 16, 2020, the NASDAQ fell from over 9800 to 6905. Here’s a look at the 2020 capital avalanche, down roughly 30% in 30 days. It has rebounded more recently, but it could resume falling or just continue to bounce around.

s been a long time since entrepreneurs have had to face an avalanche like the one we lived through, but it appears that it’s time again. In the period from Feb 19, 2020 to March 16, 2020, the NASDAQ fell from over 9800 to 6905. Here’s a look at the 2020 capital avalanche, down roughly 30% in 30 days. It has rebounded more recently, but it could resume falling or just continue to bounce around.

Let’s face it, when you’re heavy into startup mode, it’s tempting to ignore things that seem like externalities (like the public stock markets). However, in this case and at this time, that would be a huge mistake! Why? Because “as goes public equities so goes private investment” although with some caveats. But why is this the case? And how does it impact your ability to find investors?

Get our free guide for my top 5 changes that you should expect if you are raising capital.

Our Free VentureWrench Crisis Capital Guide

5 Changes In Startup Funding

in a Down Economy

With key insights to help you understand how raising startup capital

is changing while the stock market gyrates

to help you be more successful in raising capital from investors

Get Our Free Guide helps you understand profound changes in startup funding that are already starting to emerge and will continue to be more obvious over the next 18 months.

♦ How do changes in stock markets impact your potential funding round from Angel Investors?

♦ Why does market volatility impact startup capital?

♦ How are venture capital funds impacted by the public market fortunes of their limited partners?

♦ Why do these issues impact even top venture capital firms?

♦ How does the IPO market impact startup funding?

♦ Is it even possible to find investors in this economic climate?

♦ Ways to help businesses survive even during the economic downturn?

Our Free VentureWrench Crisis Capital Guide

5 Changes In Startup Funding

in a Down Economy

With key insights to help you understand how raising startup capital

is changing while the stock market gyrates

to help you be more successful in raising capital from investors

By entering your email in the box above, you confirm that you have read and agree to our terms of service, and privacy policy and agree to receive more information from us. We NEVER sell your information, your privacy is important to us! You can unsubscribe from our VentureWrench Content at any time by clicking the link in the footer of our emails. We use GetResponse as our marketing platform. By clicking above to receive your free information, you acknowledge that your information will be transferred to GetResponse for processing under GDPR regulations.