I have said for years that entrepreneurs should not try to raise capital locally. Remember, we recommend that entrepreneurs Design the Perfect Investor™ before they start raising capital. And both our experience, and the NVCA 2024 Yearbook stats below, show that the chance that your Perfect Investor™ is in your local community is vanishingly small. Basically, outside of the very largest capital markets, EVERY entrepreneur in the U.S. is in an underserved capital market!

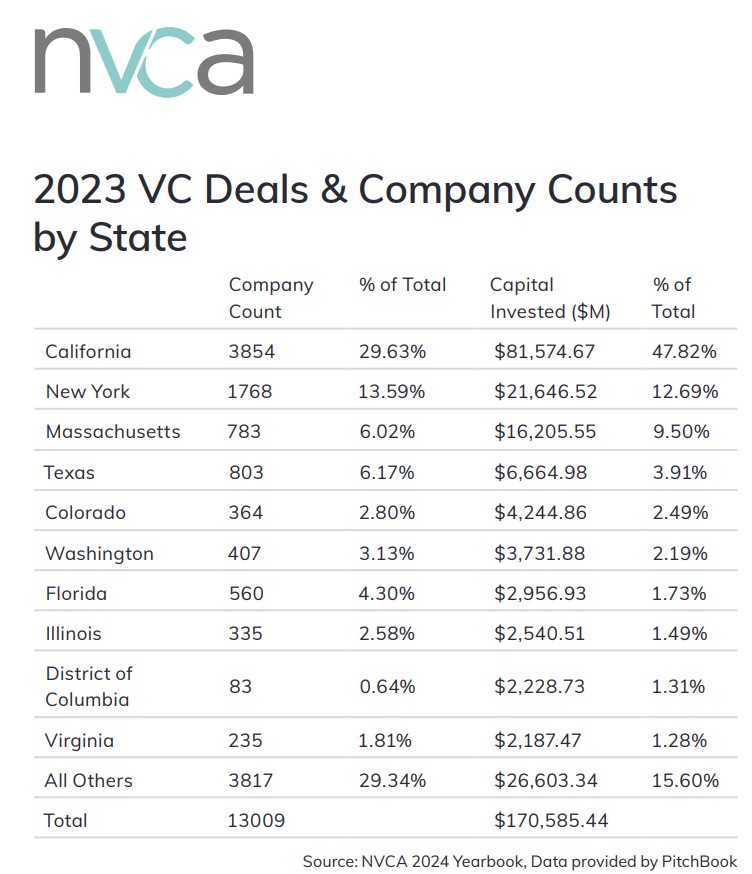

If we look at the deal count for just California and New York State, that totals roughly 43% of all the deal flow. Even worse (for entrepreneurs outside of those states), just those two states represent over 60% of invested capital in the U.S. in 2023 (waiting for 2024 data!).

If we look at the deal count for just California and New York State, that totals roughly 43% of all the deal flow. Even worse (for entrepreneurs outside of those states), just those two states represent over 60% of invested capital in the U.S. in 2023 (waiting for 2024 data!).

If we look at the top 4 states, California, New York, Massachusetts and Texas, they claimed about 55% of all 2023 deals. And in terms of capital, those states counted for about 74% of invested capital.

Let’s also emphasize that the bottom 40 states claim only 29% of 2023 deals, accounting for only 15.6% of total invested capital.

Let me reiterate, don’t try and raise capital in your local market, unless you’re in one of the largest capital markets! You are a global company in a cost competitive state, and you deserve to raise capital from your Perfect Investor™!

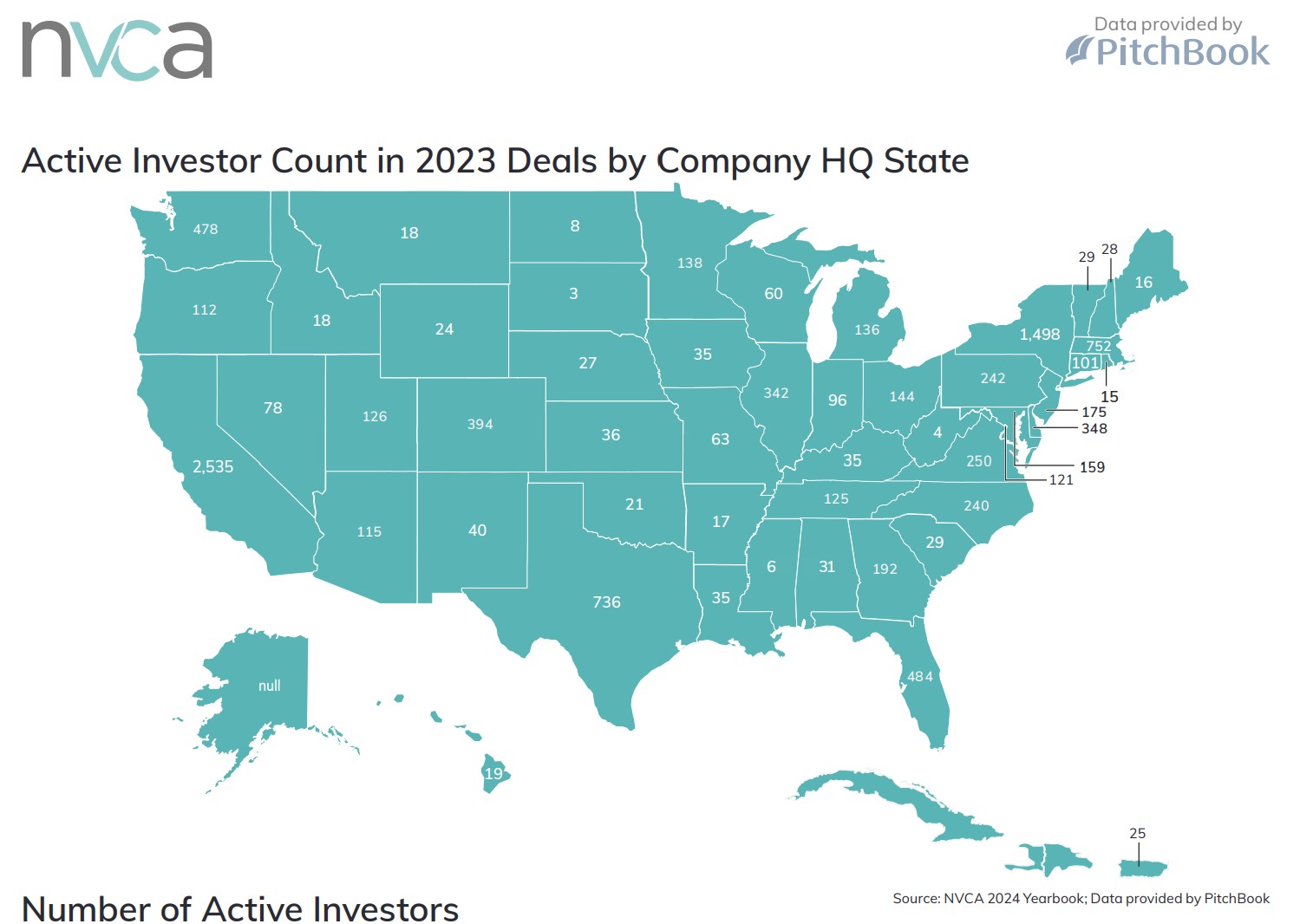

Here’s another way to look at this issue. The chart below is the NVCA active investor count by state. Clearly the deal count, dollar total and active investor count are closely correlated. Yet another reasone not to assume your Perfect Investor™ is in your state! California boasts 2535 active investors and New York has 1498 active investors, but check out the states with single or double digits!

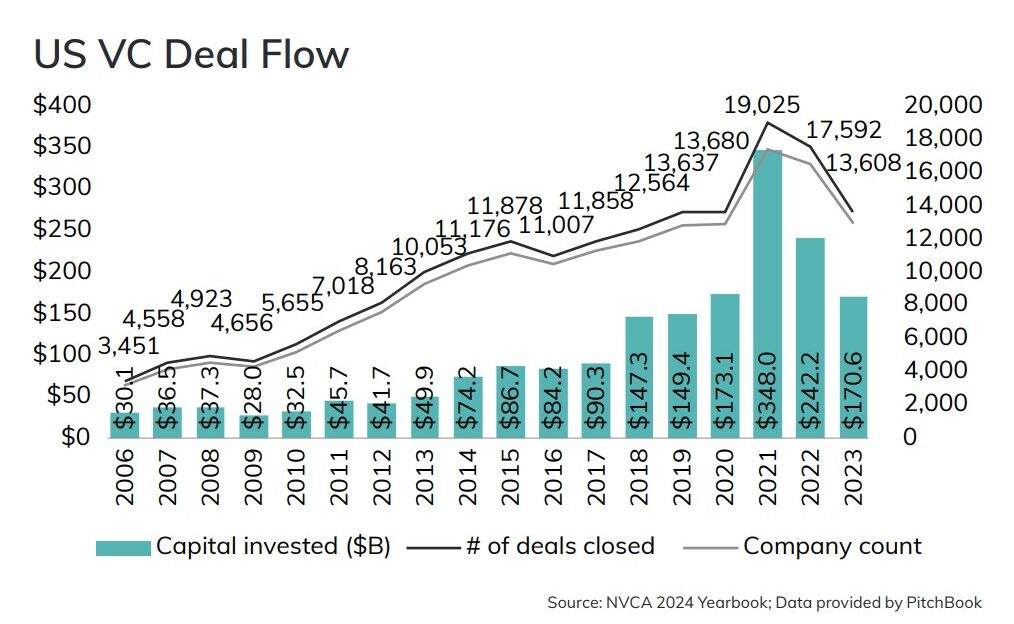

All of that said, there are dark clouds on the horizon for startup capital. Look at the 2023 deal flow. It has fallen back to 2020 levels, after huge spikes in 2021 and 2022. And analysts are bemoaning a huge overhand in capital raised by venture firms, but not being put to work.

Don’t forget, as goes Public Equity, so goes private capital

Current public equity market turmoil, suggests that angel and venture investors will pull back until they feel like the IPO markets are more robust and with a stronger appetite for new deals.

If you are raising, it is even more important to Design the Perfect Investor™ before you begin raising capital and before you potentially poison the well.

If you need help finding perfect investors, reach out to venturewrenchcommunity [at] gmail.com to ask about our InvestorFind™ Investor Identification Support“.

Interested in creating an SBIR proposal?

Click to Get our free guide “40 Ways to Improve your SBIR/STTR proposal!

If you are planning to raise funding for your startup,

Click to Get our FREE VentureWrench Guide to Investor Capital

50 pages of insider insights to help you succeed!