In 2020, in the teeth of a worldwide pandemic, economy stopping restrictions and government inaction or (often) misapplied aaction, I frankly thought we’d have some seriously tough economic times, and therefore tough startup capital times! In hindsight, I was very wrong, but at the time, I wrote about Skiing the Avalanche while raising money in the DoBox days (and offered lessons learned). I offered advice on How to Manage Your Cashflow in Uncertain Times (still relevant!). I asked, Tough Time Raising Capital? VC Investors Say it’s Going to Get Worse and offered some suggestions on What to Do! I put together a list of 5 Changes In Startup Funding in a Down Economy to help startups prepare.

In 2020, in the teeth of a worldwide pandemic, economy stopping restrictions and government inaction or (often) misapplied aaction, I frankly thought we’d have some seriously tough economic times, and therefore tough startup capital times! In hindsight, I was very wrong, but at the time, I wrote about Skiing the Avalanche while raising money in the DoBox days (and offered lessons learned). I offered advice on How to Manage Your Cashflow in Uncertain Times (still relevant!). I asked, Tough Time Raising Capital? VC Investors Say it’s Going to Get Worse and offered some suggestions on What to Do! I put together a list of 5 Changes In Startup Funding in a Down Economy to help startups prepare.

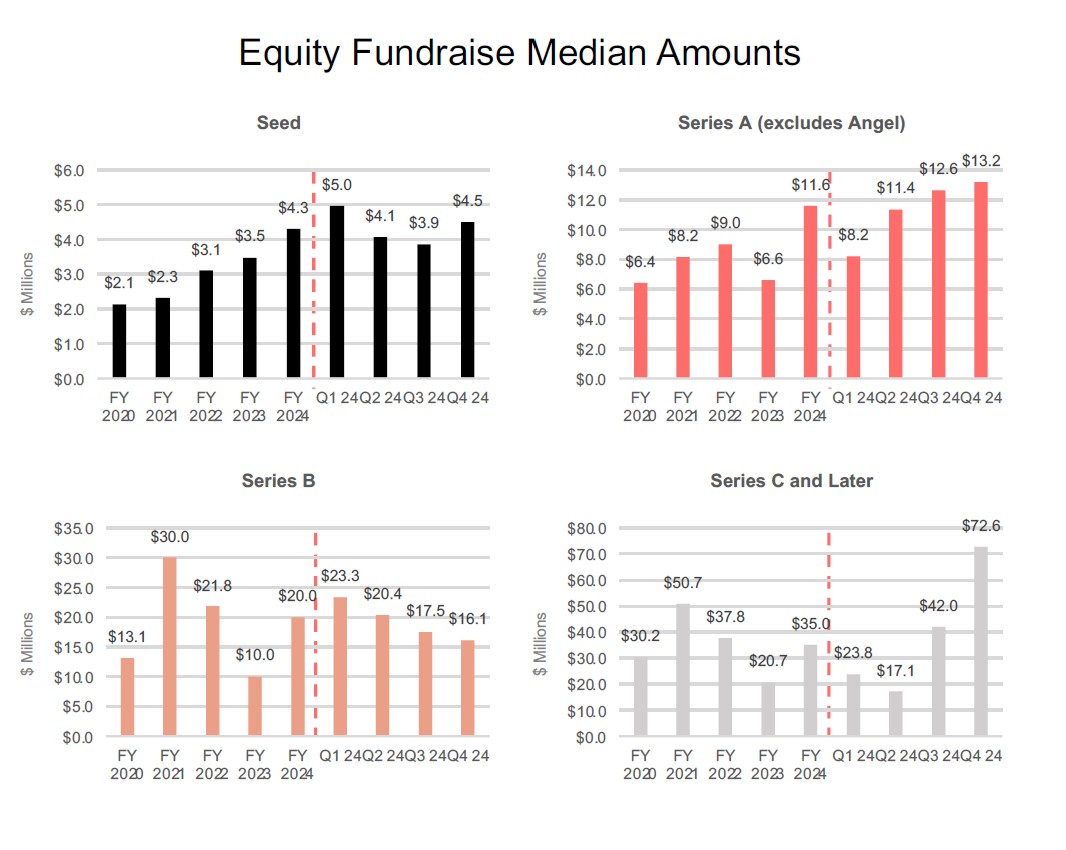

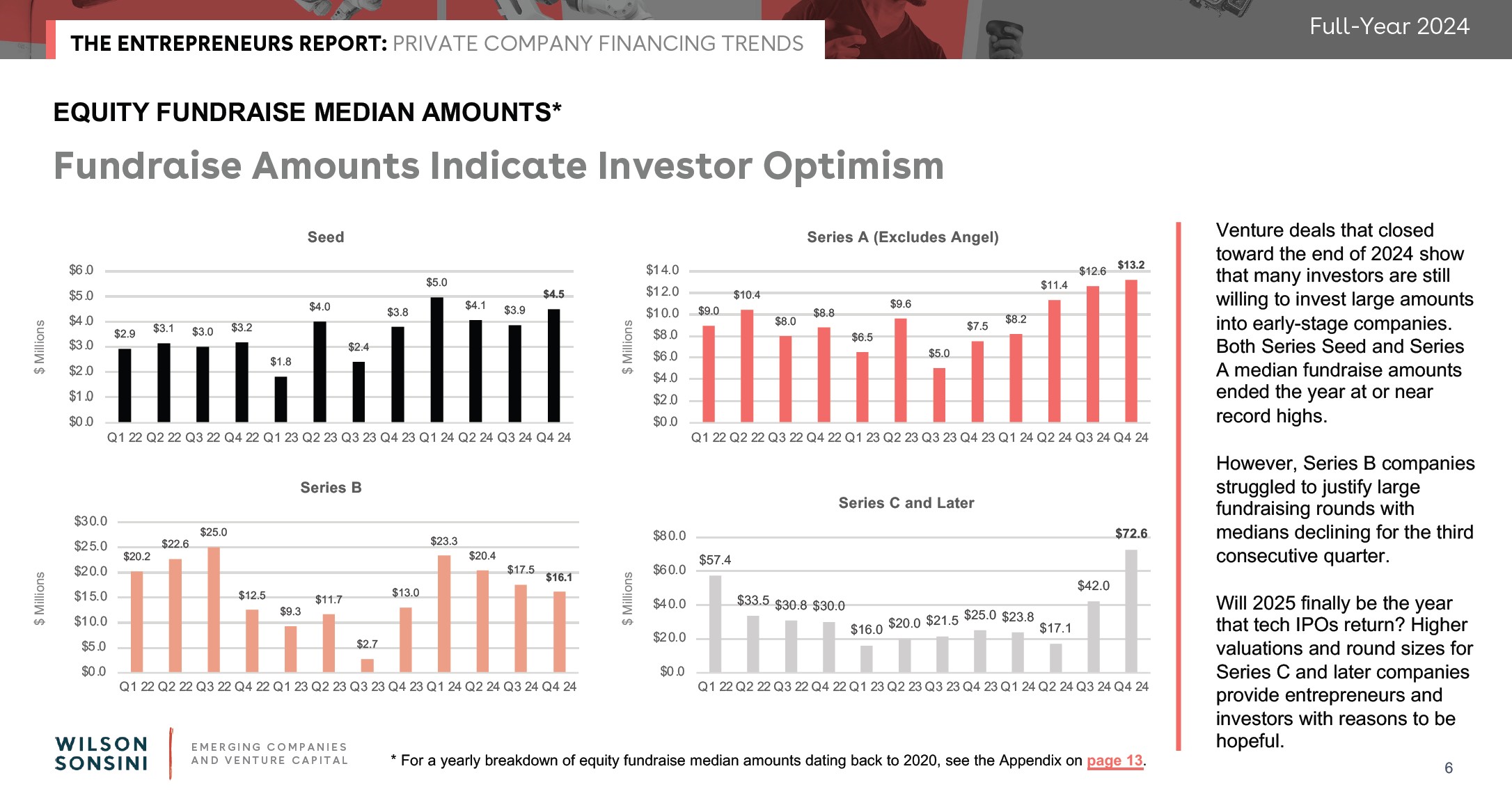

But, contrary to my expectations, below is a chart that summarizes what startup funding has looked like since 2020, courtesy of WSGR’s The Entrepreneurs Report: Private Company Financing Trends, Full-Year 2024. Quite frankly, the median equity funding raised rose quite steadily for Seed and Series A from 2020 through most of 2024, while the steady rise for Series B, C and later rounds ended with a precipitous drop in 2023 followed by some bounce back in 2024.

The median equity funding raised rose quite steadily for Seed and Series A from 2020 through most of 2024.

This is not what I expected in 2020! Frankly, from the NVCA and WSGR reports of the time, it is not what they expected either!

This is not what I expected in 2020! Frankly, from the NVCA and WSGR reports of the time, it is not what they expected either!

Seed and Series A round median values were holding up fairly well during 2024. But Series B median raise amounts are clearly painful for companies at that stage.

Series C and later is somewhat mixed, but the statistics for these later rounds have been heavily influenced by a handful of super-sized rounds in, primarily, AI companies.

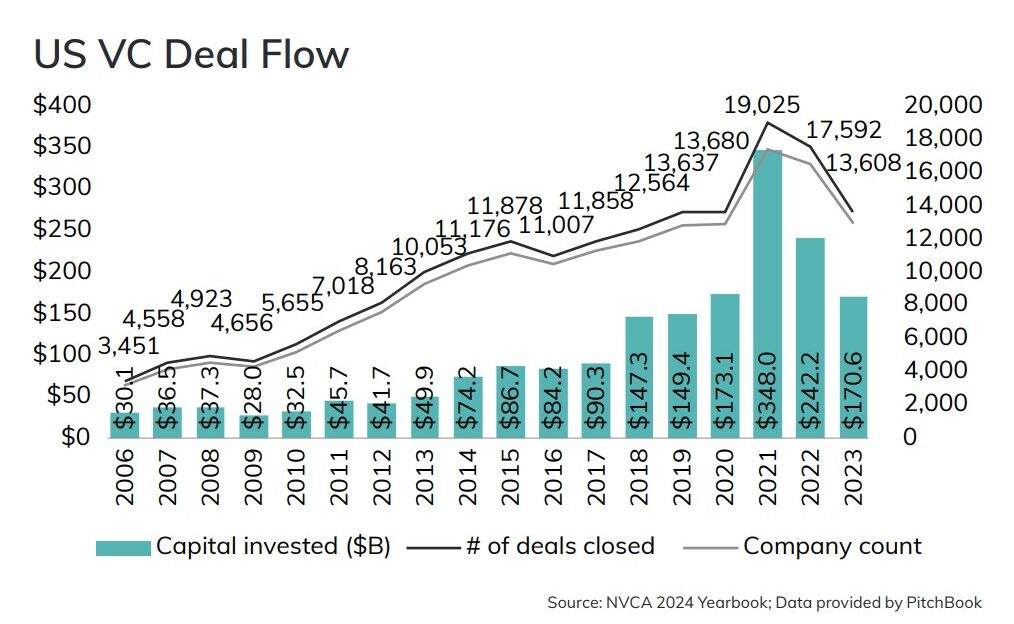

However, if you read my recent post Almost all U.S. entrepreneurs are in Underserved Capital Markets where I discussed the NVCA 2024 Yearbook stats (chart), you noticed the meaningful decline in US VC deal flow since peaking at 2021. That is only one of the disturbing stats that are emerging in early 2025.

However, if you read my recent post Almost all U.S. entrepreneurs are in Underserved Capital Markets where I discussed the NVCA 2024 Yearbook stats (chart), you noticed the meaningful decline in US VC deal flow since peaking at 2021. That is only one of the disturbing stats that are emerging in early 2025.

So what happens now? No one can predict, but being very aware of the big trends and how they can impact you can make all the difference to your fundraising, and your budgeting and planning.

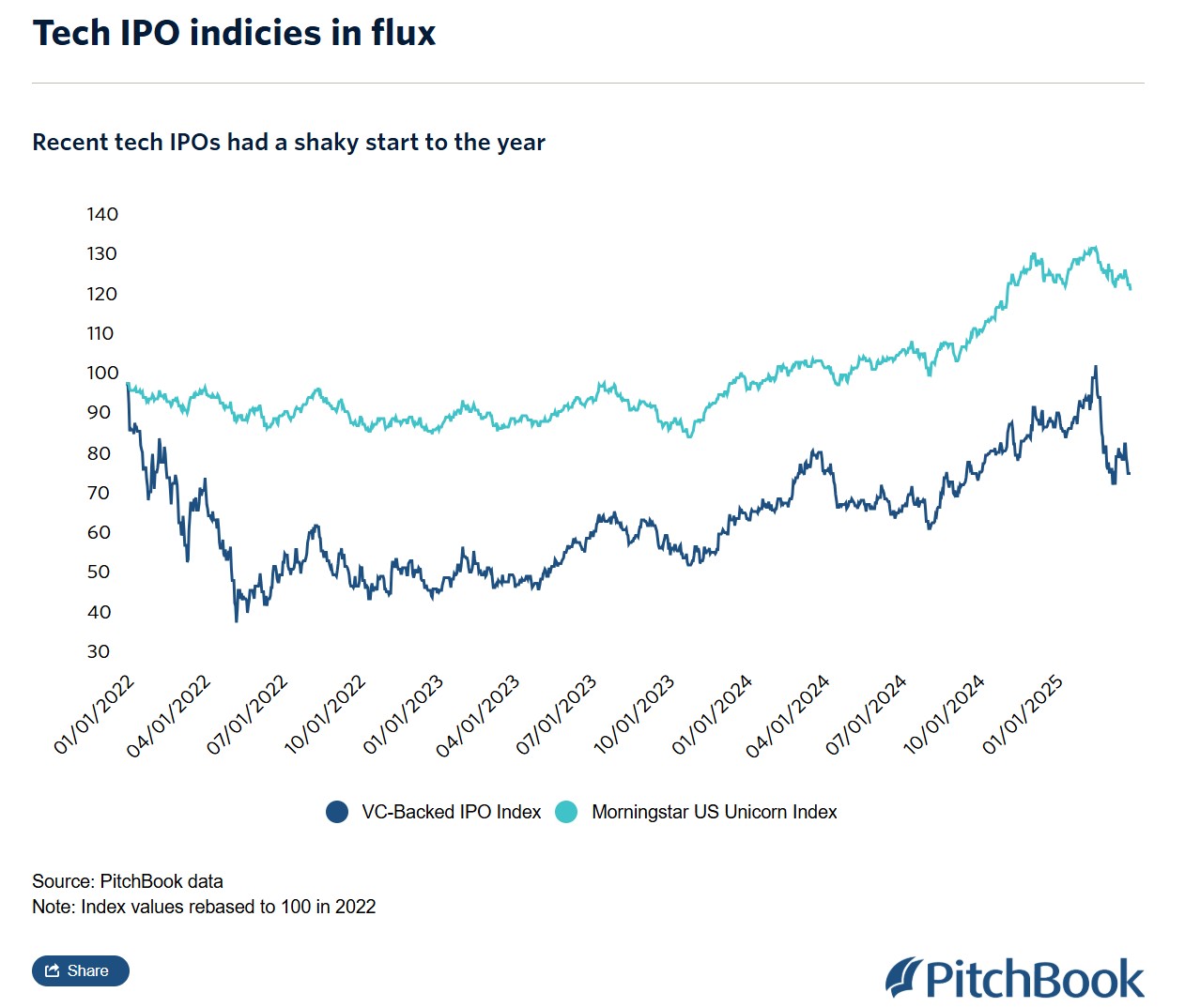

Don’t forget, as goes Public Equity, so goes private capital

In the Q1 2025, PitchBook-NVCA Venture Monitor (April 14, 2025), Pitchbook highlights that the mood of the VC community has shifted quickly with tariffs. Although Q1 2025 started with a few high profile IPOs, it masked a more difficult overall market with declining IPOs (chart) and a demand/supply ratio for capital which remained high, indicating a challenging deal-making environment. Perhaps even more concerning for startups, is that new capital commitments totaled only $10 billion, which is on track for the lowest annual fundraising total in a decade. Pitchbook expects that the poor liquidity environment is likely to continue.

From Pitchbook’s recent post – 3 charts: Why there’s no end in sight for venture’s liquidity crisis comes this illumnating look at Tech IPOs. According to the Pitchbook team, “Venture capital is not headed for the long-awaited release of exits— and liquidity—according to key IPO metrics in the PitchBook-NVCA Q1 2025 Venture Monitor.” LPs are starved for distributions, but the decline in PitchBook’s VC-backed IPO index, which has fallen 20% since the start of the year, is very worrisome.

From Pitchbook’s recent post – 3 charts: Why there’s no end in sight for venture’s liquidity crisis comes this illumnating look at Tech IPOs. According to the Pitchbook team, “Venture capital is not headed for the long-awaited release of exits— and liquidity—according to key IPO metrics in the PitchBook-NVCA Q1 2025 Venture Monitor.” LPs are starved for distributions, but the decline in PitchBook’s VC-backed IPO index, which has fallen 20% since the start of the year, is very worrisome.

Here’s the quarter by quarter breakdown in fundraising amounts since Q1 2022, which WSGR suggests indicates investor optimism. But, my recent post, Musings on a Down Round shows some pithy valuation declines which lines up more with Pitchbook’s IPO pessisims than WSGR’s purpoted VC optimism!

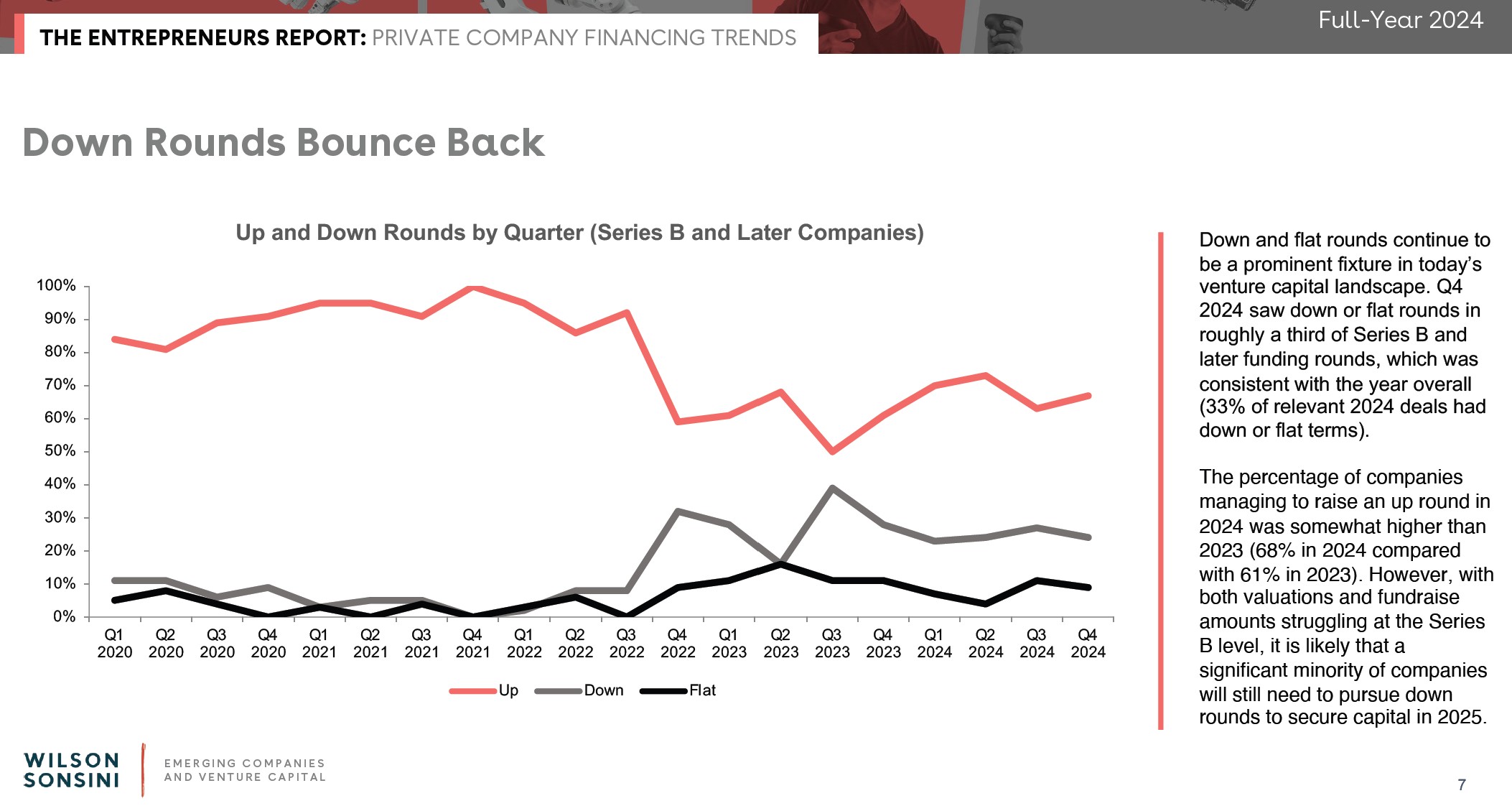

AND, WSGR’s own report shows a noticeable increase in down rounds through the end of 2024. If I were to hazard a forecast, I would assume that this downward trend will continue during at least the first part of 2025. Honestly, trying to raise a B round looks like one of the toughest spots in startup capital right now – BUT B rounds often seem to be tough!

However, Down Rounds are making a comeback!