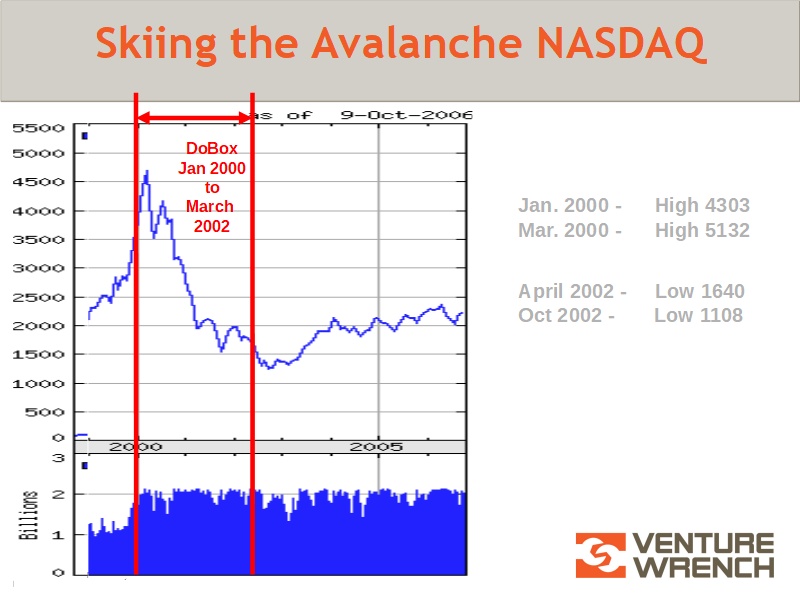

Phew! What a week – COVID-19, oil price wars and a stock market that looks like one of those childhood superballs, it bounced around so much! When I co-founded my first company, DoBox, the NASDAQ stock market was at (then) all time highs, and shortly after we raised our first round, would begin plunge of over 75% during the following two and a half years. I have long said that we “skied the avalanche” and thankfully had a successful exit anyway! As a note, the NASDAQ would not return to the 5000 level until 2015 (yes, 15 years peak to peak!)

Here’s a picture of the NASDAQ during the life of DoBox from first raise to company exit!

Here’s a picture of the NASDAQ during the life of DoBox from first raise to company exit!

While public markets plunged, private investment from angels, VC’s and PE firms dried up! And startup fundraising became excruciating. We know entrepreneurs who literally shut the doors and sent unused funds back to investors, because they knew they couldn’t raise follow-on funding.

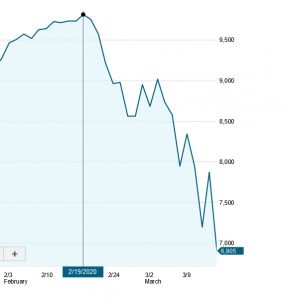

It’s been a long time since entrepreneurs have had to face an avalanche like the one DoBox lived through, it appears that it’s time again. In the last month, the NASDAQ has fallen from over 9800 (2/19/2020) to 6905 (on 3/16/2020). Here’s a look at the 2020 capital avalanche, down roughly 30% in 30 days, it could snap back…or keep falling.

Let’s face it, when you’re heavy into startup mode, it’s tempting to ignore things that seem like externalities (like the public equities markets). However, in this case and at this time, that would be a huge mistake! Why? Because “as goes public equities so goes private investment”. But why is this the case?

Investors in private companies are getting squeezed on both ends. When a Venture Fund gets commitments from their investors (their LP’s), the commitment is brought into the fund in tranches over the life of the fund.

It’s not like a $500 million fund actually has $500 million sitting in some bank account somewhere, they have a commitment from their investors for the $500 million, but usually only have a portion of those funds actually in h and. And when public equities plummet, as they have been over the last few weeks, often those “commitments” dry up.

and. And when public equities plummet, as they have been over the last few weeks, often those “commitments” dry up.

Let me repeat that, yes, indeed, frequent investors in venture capital such as retirement funds, endowments and foundations, do renege on their commitments! So, all of a sudden a $500 million VC fund could be much, much smaller. And (if you’ve taken our course Designing the Perfect Investor™ you would know why this is the case…) much of the remaining money will be reserved for existing portfolio companies, not new investments. VC’s (and entrepreneurs) have been assuming “abundant capital”, but if that’s no longer the case, how does that impact you?

Now, on the other end, falling public equity markets also squeeze potential exits. One of my first Directors was a retired VC, and when the last plunge started he said that VC’s would need a year to “fix or kill” all their troubled portfolio companies. Well, it took a lot longer than that! And, given the amount of money that has flowed into startups with no path to profitability during the past few years, it will probably take more than a year to fix this crop too.

According to many experts in public equities, the IPO market closed late last year (remember the WeWork debacle?) and will likely not recover any time soon. Which means that all of those companies that have little or no path to profitability and are burning a ton of cash will 1) need more capital and 2) be unlikely to be attractive to public markets for a long time!

My hunch is that history is about to repeat itself and many VC’s will find themselves with way too many companies who need capital and who can’t get bought or go public. So new investments will not be at all high on their priority list. One VC told me (last time) that he was on the board of 10 private companies, and he preferred close to 6 or 7! His time was limited with too many companies who needed too much help and cash.

Bonus Tip: Given the current environment, a “Perfect Investor” is an investor who is investing “right now.” That means the investor actually has cash on hand to invest! So be sure to ASK, “do you have cash on hand to invest right now?” (the alternative is that they have to make a capital call for fresh cash!) If they don’t, ask when they expect to be investing in new deals.

So, if history is about to repeat itself, what should the savvy entrepreneur do? First, make sure you have the magic “path to profitability”, if you don’t have one now, make it a priority to develop one now. Second, focus on getting 2 years of capital on hand which may involve both that capital raise and slowing your burn rate. Third, you know my perspective – make sure you, Design the Perfect Investor™. Get focused on only those strategic investors who already want what you offer (see next week’s post for more on this!), and then get expert coaching to help you create compelling pitches and docs to get their attention and to look smart and savvy!

So, if history is about to repeat itself, what should the savvy entrepreneur do? First, make sure you have the magic “path to profitability”, if you don’t have one now, make it a priority to develop one now. Second, focus on getting 2 years of capital on hand which may involve both that capital raise and slowing your burn rate. Third, you know my perspective – make sure you, Design the Perfect Investor™. Get focused on only those strategic investors who already want what you offer (see next week’s post for more on this!), and then get expert coaching to help you create compelling pitches and docs to get their attention and to look smart and savvy!

To save you even more time, order a custom search of our InvestorFind™ curated investor database. Whatever we find in our search, a minimum of 20 to 25 Perfect Investors, and usually many more than that, you get the info on those investors and develop your fundraising strategy accordingly.

Successful companies are started during hard times, but it takes persistence and savvy, so get ready to dig in!

More Bonus Insights:

Here are links from some VC’s and LP’s on the front line giving you some further insight into their view of the current situation. Get focused on strategic perfect investors!

Coronavirus: The Black Swan of 2020 from Sequoia Capital to their Founders and CEOs

The VC Fundraising Environment and COVID-19 by Elizabeth “Beezer” Clarkson, Managing Director at Sapphire Partners (a Fund of Funds LP in venture funds)

Early Stage Technology Funding In The Time Of Coronavirus published on Forbes.com by Nisa Amoils

———————-

Our Free VentureWrench Crisis Capital Guide

5 Changes In Startup Funding

when Stock Markets Plunge!

With key insights to help you understand how raising startup capital

is changing while the stock market gyrates

to help you be more successful in raising capital from investors

1 thought on “Skiing the (Stock Market) Avalanche – Lessons Learned!”

Comments are closed.