In 2019, I wrote a post about how to create a great name and brand for your company. You can read the whole post “What’s in a name? Just don’t let it be Bolt!”, but here’s the summary:

“Online watchers noted that two startups, both named “Bolt”, from very different industries, each raised about the same amount of money from VC’s ($67 and $68 million respectively). One (bolt.eu) is an Estonian ridesharing, food delivery, and scooter business, the other (bolt.com) is a San Francisco based company aiming to make the perfect online checkout process. Really? You couldn’t come up with something more interesting? There wasn’t anything cooler in Estonian?

Worse, according to Crunchbase, 59 companies in Crunchbase have names that start with Bolt (bolt.earth, bolttech, boltthreads….) and I will note that very few of them seem to have anything to do with, well, actual bolts. This is but one, particularly egregious, example of the startup naming problem.”

Of course I was criticizing the name (a pet peeve and frequent strategic error), but the name was only the beginning of Bolt’s problems. Guess what happened?? Having a boring and non-unique name didn’t help preserve Bolt’s valuation, or their unicorn status!

Last year, CB Insights’ Valentine’s Eve newsletter had some pithy commentary about Bolt under their “What’s Hot or Not” section (2/13/2024) which grabbed my attention. Here’s what they said:

“Not [Hot]: Bolt’s valuation. Bolt…has taken a hit. The startup building an incredibly unique & proprietary 1-click checkout technology is buying back shares at a $300M valuation, per The Information.

That’s a 97% drop from its $11B valuation from 2 years ago. It’s raised over $1B of financing.

Every round of investors is getting torched here (as are employees).

Liq pref is not much help here.

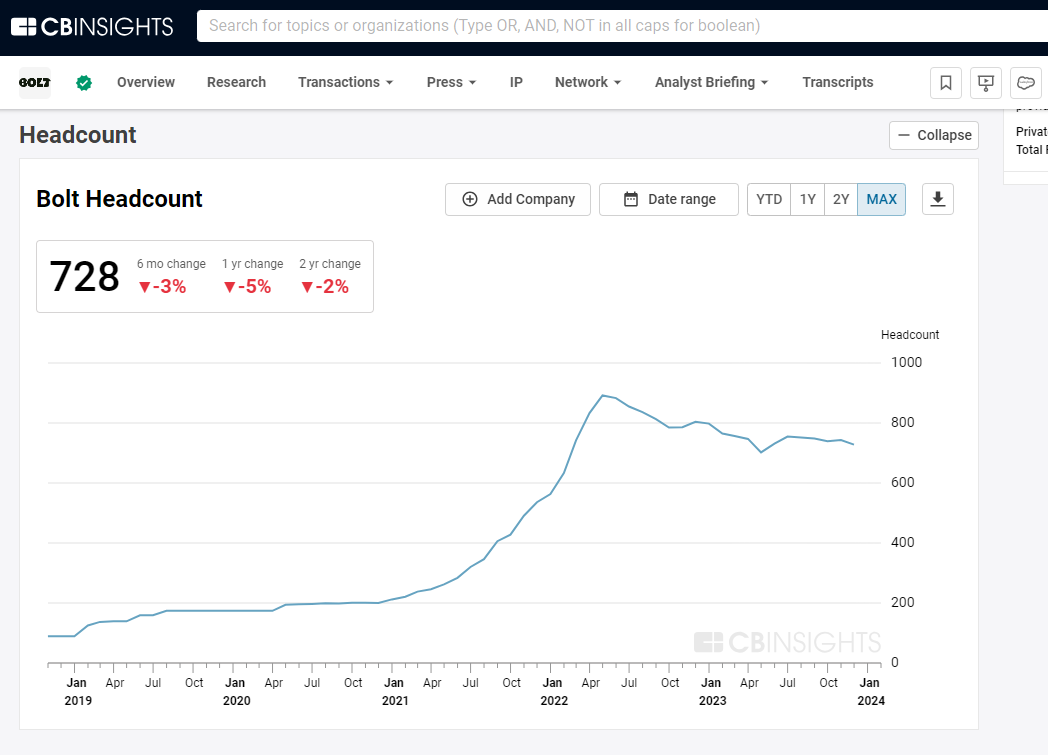

Shockingly, the company, per CB Insights headcount data, still has over 700+ employees. The slash in valuation is brutal but not at all surprising given the powers of the Stripe Mafia.”

I (Nicole) have said before, focusing on being a Unicorn (which Bolt used to be) isn’t the goal. Building a customer serving, revenue generating, profitable business IS the goal!

I (Nicole) have said before, focusing on being a Unicorn (which Bolt used to be) isn’t the goal. Building a customer serving, revenue generating, profitable business IS the goal!

Stay focused on what’s important and deliver, deliver, deliver.

But this very bad news for Bolt got me thinking about what happens to your company when you go through a down round, and particularly one as devastating as this one. Some consequences that you have to be ready to manage before you decide to transact at such a discount are:

- Angry investors

- Defecting Board Members

- Devastated employees

- Concerned Clients

- Angry investors – Investors who put money in at high valuations are angry. They may try and write off your investment, or may be willing to sell their stake in order to book the loss and get rid of the problem. That may further depress your valuation (can you say fire sale?) and your company may become a “persona non grata” in the investment community. Examine with your attorneys and your Board what the options are to restore faith in your business among investors, even with a significant decline in valuation. But remember, be fair to all of them!

- Defecting Board Members – VCs who invested, and now sit on your board, have a double frustration. First they are angry investors and trying to salvage what they can of the investment, or just get rid of it. Second, they are Board Members. They are now spending time on a deal that they have lost faith in, or at least that will not be profitable for them.

VC’s can only serve on so many boards, and it is often this personal constraint rather than a constraint on available money that restricts the numbers of deals they can invest in.

So, be ready for VC Board Member to get their firms out of your company and resign from your Board as soon as they can (even if they believe the down round was the right thing! even if they had become a mentor! or even a friend.) You and your deal are old news.

- Devastated employees – It is very true that a company that has had a serious down round can still be a success as a business. But that success is absolutely predicated on a capable and loyal team! But imagine. If, instead of being a founder, you were an enthusiastic employee who came when the valuation was (sky)high, when they had just joined a unicorn and they had private company stock options!Wow. Their social credit was HUGE. They looked forward to converting those options into serious wealth. And then, not just crushed but ground into powder.

Their dreams gone, their options so underwater there is no hope of profitability. And of course, your shame, and worse, their shame, is all over the internet for everyone, including their social circles, to see. Finally, some of their peers start to leave like rats off a sinking ship.

They start to worry, is it a sinking ship or one that is just enduring some rought water. And you start to hire replacements. And when you do, you give out options. New, low cost options. In the money options. Options that may one day be worth something. Options that they don’t have.

You have to get serious about how to keep those employees. Flush old options? grant new options? do something else? And how do any of those pro-employee moves impact investors? - Concerned Clients – Again, since funding rounds and unicorn status are very public, and any fall from grace even more public, your customers will know almost as soon as you do about the down round. And, like your employees, they may wonder if they’ve signed on to a sinking ship.

You need to keep your clients and keep them happy! So you’ve got to spend time doing damage control (while Board Members, investors and employees are leaving…) But, do it. Spend the person time. Explain the plan. Identify how existing funding is sufficient, or how long your runway is. Help them focus on the solution you bring.

And this is more relevant than you might think. Just this week (February 2025) CB Insights’ newsletter follows up with more What’s Hot and What’s Not with these stats about the 2014-2024 cohort of Unicorns so far.

The CB Insights team opines:

“Not Hot: Zombie unicorns

The unicorn boom is fading.Over one-third of today’s 1,200+ unicorns haven’t raised funding since 2021.

And more than 100 sit precariously at a $1B valuation — one down round away from losing their status. With the public markets largely shut, many of these unicorns are stuck in limbo.

As investors grow more selective, many late-stage startups face a stark choice: accept steep valuation cuts, sell at a discount, or risk becoming unicorpses. ” (You can get the full picture of the unicorn landscape from CB Insights)

Want more help from the VentureWrench team?

If you want more in depth help, either a proposal review or help developing your proposal, you can apply for a spot in our one-on-one VentureWrench SBIR Coaching programs after you’ve gone through the course. Email us at venturewrenchcommunity [at] gmail.com with questions.

If you want more in depth help, either a proposal review or help developing your proposal, you can apply for a spot in our one-on-one VentureWrench SBIR Coaching programs after you’ve gone through the course. Email us at venturewrenchcommunity [at] gmail.com with questions.

And if you need help with any part of your SBIR process – proposal (Phase I or II), TABA, proposal management, or contract finalization, just email us at venturewrenchcommunity [at] gmail.com and we can discuss what you need.

Don’t forget, if you need more help with your SBIR or STTR proposal, check out our online course, Develop a Winning SBIR Strategy, and don’t forget your free guide below!

Interested in creating an SBIR proposal?

Click to Get our free guide “40 Ways to Improve your SBIR/STTR proposal!

If you are planning to raise funding for your startup,

Click to Get our FREE VentureWrench Guide to Investor Capital

50 pages of insider insights to help you succeed!