Crowdfunding for equity – I still say “just say no”, especially to raising funds from unaccredited investors*, but there can be methods to make equity crowdfunding work. Read on.

People believe the JOBS Act made it easy to crowdfund for equity…. entrepreneur beware! Ever since the 2012 “Jumpstart Our Business Startups (JOBS) Act“, which is supposed to make equity crowdfunding more feasible, there has been this aura of “the magic of the crowd” for equity crowdfunding. Many people think of crowdfunding for equity like the freewheeling world of crowdfunding for Stuff (or rewards) that I have previously written about. The idea seems to be that, now, anyone can invest in anything. It is essential to remember this is NOT true! Obviously the JOBS Act does help equity crowdfunding by allowing companies to sell shares of stock to a potentially wider array of investors, with easier reporting requirements than in the past. Essentially equity crowdfunding is a broader version of an angel round of funding with some additional flexibility and selected online marketing opportunities.

there has been this aura of “the magic of the crowd” for equity crowdfunding. Many people think of crowdfunding for equity like the freewheeling world of crowdfunding for Stuff (or rewards) that I have previously written about. The idea seems to be that, now, anyone can invest in anything. It is essential to remember this is NOT true! Obviously the JOBS Act does help equity crowdfunding by allowing companies to sell shares of stock to a potentially wider array of investors, with easier reporting requirements than in the past. Essentially equity crowdfunding is a broader version of an angel round of funding with some additional flexibility and selected online marketing opportunities.

However, just because the JOBS act, and the accompanying Regulation A, reduced reporting requirements for companies selling stock, it did NOT eliminate them (see the SEC’s Small Business guide – Amendments to Regulation A: A Small Entity Compliance Guide) . The JOBS act is still quite complex and any entrepreneur raising money this way needs a good securities attorney at their back! Don’t believe me? Visit the “SEC details on Amendments for Small and Additional Issues Exemptions Under the Securities Act (Regulation A), a Rule by the Securities and Exchange Commission on 04/20/2015” for more!

However, equity crowdfunding CAN work for the entrepreneur, but there’s a lot you need to know to be successful in leveraging the crowd to raise equity funding. We will start with the simple idea that crowdfunding for equity means selling equity to more investors than you may have done with a traditional angel round, with some investors investing as little as $1000, or even less, compared to a more traditional angel investment minimum of at least $10,000 and usually $25,000 or $50,000 per investor.

There are really two “parts” to equity crowdfunding, one is “marketing” an equity crowdfunding deal, which, under the JOBS Act, must be done through an SEC approved platform. No, you cannot run a bunch of Facebook ads offering equity in your cool startup! That will get you in a LOT of trouble. A number of equity crowdfunding platforms handle ONLY this marketing function. They essentially function as a matching platform, while the actual investment takes place outside of the platform.

The second part of equity crowdfunding is the actual transfer of money AND the backend management of documents and reporting for the investors. It turns out this is a LOT of work over both the short and long term. Some equity crowdfunding platforms handle these “second half” functions as well as the marketing function.

Remember, just because you are on a crowdfunding platform, don’t assume the platform will bring you the crowd! Most Equity Crowdfunding deals are being done with a strong angel investor lead! Have you found your “designer investor” lead?

One of the major issues with raising an angel round, or a crowd round is the challenge of managing many investors.  When you go to raise further funding, you need signatures from all of those investors! If the follow on investors want specific terms or preferences, or feel that they need to renegotiate the preferences of earlier investors, ALL of those angel or crowd investors have to sign on! So every individual person has to be managed, even if they’ve moved, disagree with the new terms or new investors, or just get grumpy. No matter what, you have to get their to sign off! What this means, practically, is that early investors can prevent you from getting follow on funding from more sophisticated investors, and therefore can single-handedly doom your company. Sad, but true. Of course as long as everything is going well, it’s not an issue, but if there is ever a hiccup, and there is always a hiccup, watch out. I speak from experience that this is a lot of work. We raised $2.6 million from about 30 very sophisticated angel investors for our previous award-winning startup, DoBox. They were fantastic investors, but keeping up with the paperwork required a team!

When you go to raise further funding, you need signatures from all of those investors! If the follow on investors want specific terms or preferences, or feel that they need to renegotiate the preferences of earlier investors, ALL of those angel or crowd investors have to sign on! So every individual person has to be managed, even if they’ve moved, disagree with the new terms or new investors, or just get grumpy. No matter what, you have to get their to sign off! What this means, practically, is that early investors can prevent you from getting follow on funding from more sophisticated investors, and therefore can single-handedly doom your company. Sad, but true. Of course as long as everything is going well, it’s not an issue, but if there is ever a hiccup, and there is always a hiccup, watch out. I speak from experience that this is a lot of work. We raised $2.6 million from about 30 very sophisticated angel investors for our previous award-winning startup, DoBox. They were fantastic investors, but keeping up with the paperwork required a team!

One of the great innovations in the equity crowdfunding market is the “Special Purpose Vehicle” or SPV. This is essentially a specially created LLC where all potential investors put their money into the SPV, with one experienced investor, usually a seasoned angel investor with a large stake, acting as the representative of all the investors to the company. Once the SPV is created and funded, the SPV invests in the startup. There are special rules by the SEC for investment into a startup by another company (aka the LLC) that makes this easy.

For the entrepreneur this is incredibly helpful! No matter how many investors are invested in the SPV, even those small investors, the entrepreneur deals only with the representative of all the investors, again, usually an experienced angel who knows “how the game is played”. It is important to note that, in general, all of the investors in the SPV must be accredited investors* meeting certain SEC specified requirements (again, this is not a DIY project, get a securities attorney!).

One of the leaders in SPV’s are our colleagues at Assure Services (Assure.co). They have created a compelling and efficient “backend” they call their Glassboard app, that allows many (accredited) investors to integrate into one of their SPV’s which invests in the startup, and then Assure handles a host of annoying and historically expensive tasks like managing taxes and k-1 forms and reporting for all the members of the SPV. I have long regretted they weren’t around when we raised our funding for DoBox! Assure not only provides services directly to entrepreneurs who are managing their own equity angel or crowdfunding raise, but also provides backend services for other equity crowdfunding groups and platforms. Make sure any platform you use offers these capabilities, it will reduce your workload, and I say that from experience.

Raising money is the negotiation of a lifetime, are you ready? Do you know how investors really work?

You will notice that, when talking about the magic SPV, only accredited* investors are welcome. That is part of the SEC regulations related to the JOBS Act. It is also a bummer.

Under the JOBS act, it is permitted that unaccredited investors can participate under certain rules and restrictions and up to certain levels of their income and assets (did I mention a securities attorney?). There are a couple of of the crowdfunding platforms that do support this type of unaccredited investor equity crowdfunding which is often referred to as “Regulation Crowdfunding” . But even the largest of these platforms has helped get funding for only a few hundred companies, most of them already incubator graduates.

Angel investors do an estimated 50,000 and 100,000 deals each year in the U.S. along (varying by economic climate), so we can see that the stated vision of these regulation crowdfunding platforms to democratize startup funding is, so far, slow to take hold. I think that may be because every entrepreneur needs to remember that unaccredited* investors can pose problems in the long term. If you plan to ever raise money from institutional investors such as Venture Capital or Private Equity firms, they will not be pleased to have to deal with unaccredited investors and quite frankly you will probably not be pleased either!

If you decide to go after equity crowdfunding, don’t rely on the platforms to educate you particularly well. There is a lot written but little communicated on the various platform websites because much jargon is used. I highly recommend a good securities attorney! And don’t think of equity crowdfunding as a miracle to solve all your funding problems, instead consider it a way to reach more broadly into the community of (accredited*) angel investors outside of your personal network through the marketing platform function, AND a way of reducing your short and long term investor management workload by closing the deal using an SPV and accompanying management services! Happy funding!

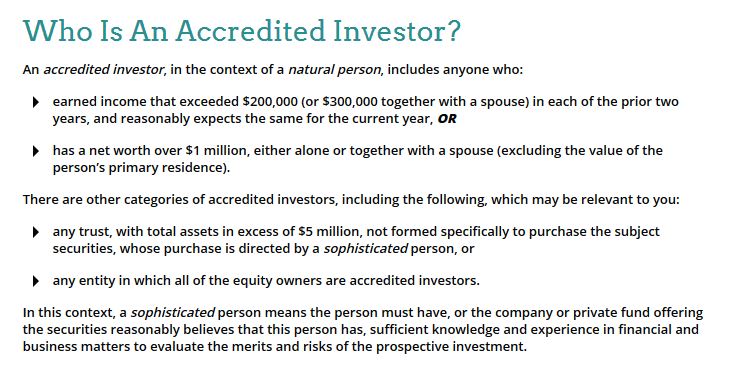

* Below is the SEC’s definition of an accredited investor and you can read more details from the SEC about accredited investors on their site.

2 thoughts on “Crowdfunding for Equity”

Comments are closed.