Before we talk about the strategic environment, it seems wise to think for a moment about strategy. A Business strategy includes the firm’s overall goals and objectives and provides a high level working plan for achieving its vision and mission, helping the leadership team prioritize objectives to help the company compete successfully and optimize its business model and financial results. Typically a business strategy will cover a period of about 3-5 years or longer depending upon the industry.

When I work with entrepreneurs who are struggling to move their business to the next level, I often suggest that we spend some time on strategic analysis. Many entrepreneurs are familiar with the basic SWOT analysis – Strengths, Weaknesses, Opportunities or Threats. This analysis is often very focused on a specific market – the company’s strengths and weaknesses as it competes with certain products or services. And, as such, it is very useful. However, the SWOT analysis is not always as helpful when we consider the overall strategic environment facing the company as a whole

When I work with entrepreneurs who are struggling to move their business to the next level, I often suggest that we spend some time on strategic analysis. Many entrepreneurs are familiar with the basic SWOT analysis – Strengths, Weaknesses, Opportunities or Threats. This analysis is often very focused on a specific market – the company’s strengths and weaknesses as it competes with certain products or services. And, as such, it is very useful. However, the SWOT analysis is not always as helpful when we consider the overall strategic environment facing the company as a whole

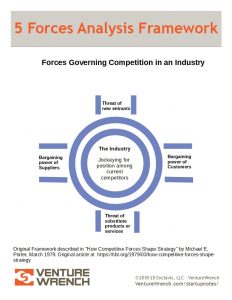

To address this, we turn to a lesser known, but very powerful, industry analysis first put forward by Michael Porter in 1979, the “5 Forces” analysis. It was named, more completely, “The Five Competitive Forces That Shape Strategy” that helps leaders examine the potential profitability in an industry or strategic alternative.

To address this, we turn to a lesser known, but very powerful, industry analysis first put forward by Michael Porter in 1979, the “5 Forces” analysis. It was named, more completely, “The Five Competitive Forces That Shape Strategy” that helps leaders examine the potential profitability in an industry or strategic alternative.

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Rivalry among existing competitors

What makes this analysis so powerful is that it helps leaders really assess where the fundamental challenges in the industry are. For example, a company that is a government contractor for “commodity” products (often known as “COTS” or commercial off-the-shelf) or services has a problem with the bargaining power of buyers because there is only one or a small number of government buyers. In addition, there is a high threat of new entrants, because an RFP is intended to make sure that every entrant responds to the same requirements. This combination of factors yields fierce rivalry among existing competitors which, of course, reduces profitability.

Sometimes the strategic power is in the hands of suppliers. For example, in the PC industry, the actual builders of PC’s have always been at the mercy of two key suppliers, the chip supplier (for a long time Intel was the dominant player in the microprocessor business, although AMD has really made competitive inroads more recently), and the OS supplier, Microsoft. These two component vendors extract almost all of the profits from the PC business, leaving only crumbs for the companies who delivered the final product.

So, don’t let a poor strategic environment deep six the profitability and potential of your company – instead make sure you use the 5 Forces analysis to help you understand the environment you face. If you’d like more help, grab my course, Business Strategy for Entrepreneurs, which includes 4 hours of coaching plus my extensive strategy workbook.

We are Working our Way Through 10 Reasons Startups Die

-

Destructive corporate culture

-

Failure of product – market fit

-

Founder issues and conflict

-

Staffing and Team problems – poor hiring choices or inability to prune staff appropriately

-

Can’t raise sufficient capital

-

Run out of cash after raising capital

-

Scaling too soon or improperly

-

Intractable technical problems

-

Poor strategic environment

-

Regulatory problems (forseen or unforseen)

———————-